YOUR GO-TO BROKER

FOR TRADING

FOR TRADING

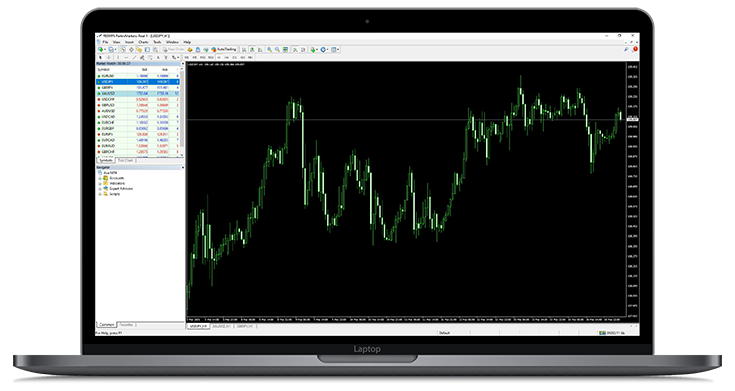

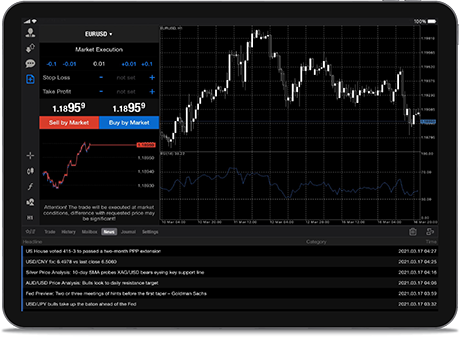

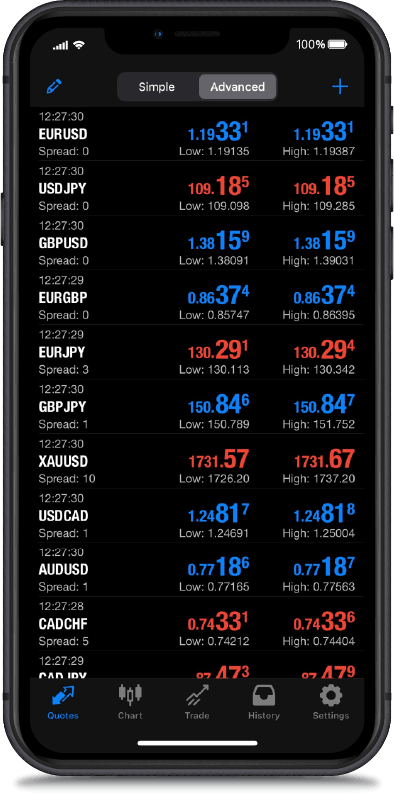

Access 350+ products including Forex, Share CFDs, Indices and Metals with MetaTrader 4/5 Platforms

LIVE SPREADS

EUR / USD

SPREAD

0.00

BID

-----

ASK

-----

XAU / USD

SPREAD

0.90

BID

-----

ASK

-----

EUR / JPY

SPREAD

0.10

BID

-----

ASK

-----

USD / JPY

SPREAD

0.00

BID

-----

ASK

-----

GBP / USD

SPREAD

0.20

BID

-----

ASK

-----

Live prices are indicative only.

STANDARD

No Commission

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Min. Deposit $100

- Max. Leverage 1 : 500

RAW

Low Commission

$2.5/side

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Min. Deposit $100

- Max. Leverage 1 : 500

ACCOUNT TYPE

THAT SUITS YOU BEST

THAT SUITS YOU BEST

At RADEX MARKETS, we commit ourselves to offering competitive trading setups and execution.

ENHANCE YOUR TRADING JOURNEY WITH US

Trade like never before with our optimal features. Our seamless and user-friendly platform enables you to navigate the markets with ease.