EL MEJOR ALIADO PARA

TU TRADING

TU TRADING

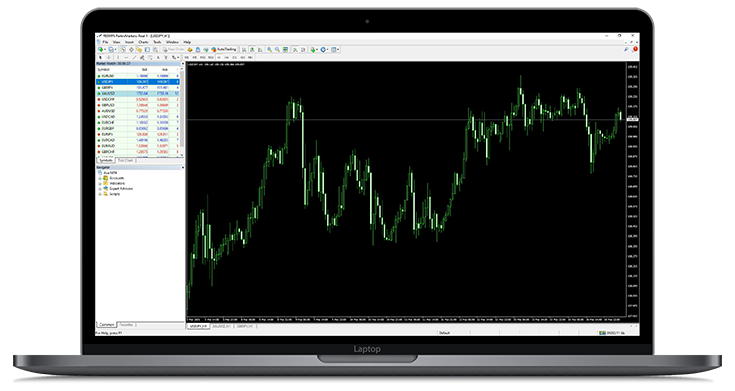

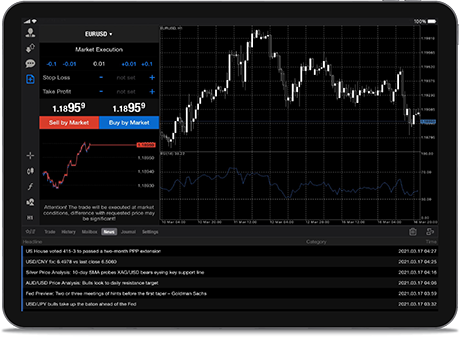

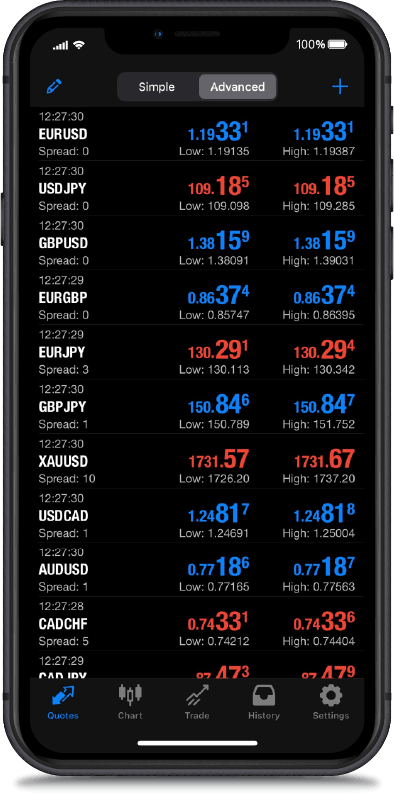

Acceso a +350 productos como Forex, Acciones, CFDs, Commodities, Índices y Metales con plataformas de MetaTrader 4/5.

LIVE SPREADS

EUR / USD

SPREAD

0.00

COMPRA

-----

VENTA

-----

XAU / USD

SPREAD

0.90

COMPRA

-----

VENTA

-----

EUR / JPY

SPREAD

0.10

COMPRA

-----

VENTA

-----

USD / JPY

SPREAD

0.00

COMPRA

-----

VENTA

-----

GBP / USD

SPREAD

0.20

COMPRA

-----

VENTA

-----

Los precios Live son orientativos

STANDARD

Sin comisión

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- DEPÓSITO MÍNIMO $100

- APALANCAMIENTO 1 : 500

RAW

Baja comisión

$2.5/lado

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- DEPÓSITO MÍNIMO $100

- APALANCAMIENTO 1 : 500

Tipo de cuenta

que mejor se adapta a ti

que mejor se adapta a ti

En Radex Markets nos comprometemos a ofrecer un entorno de trading competitivo.

MEJORA TU TRADING VIAJA CON NOSOTROS

Opera como nunca antes con nuestras características óptimas. Nuestra plataforma perfecta y fácil de usar permite navegar por los mercados con facilidad.