ТАНЫ АРИЛЖАА ХИЙХ БРОКЕР

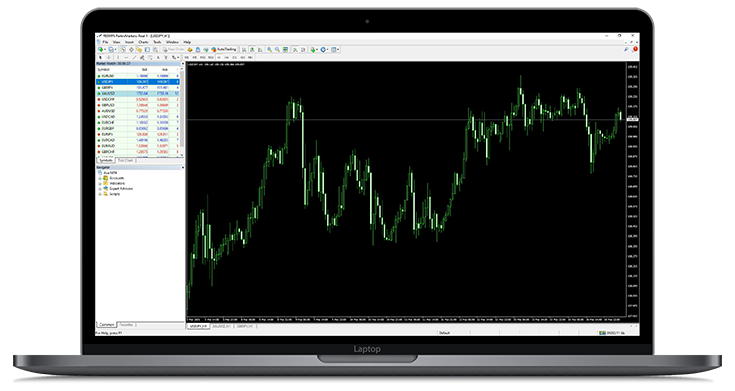

MetaTrader 4/5 платформоор Forex, CFD, индекс, металл зэрэг 1000 гаруй бүтээгдэхүүнд нэвтрэх боломжтой.

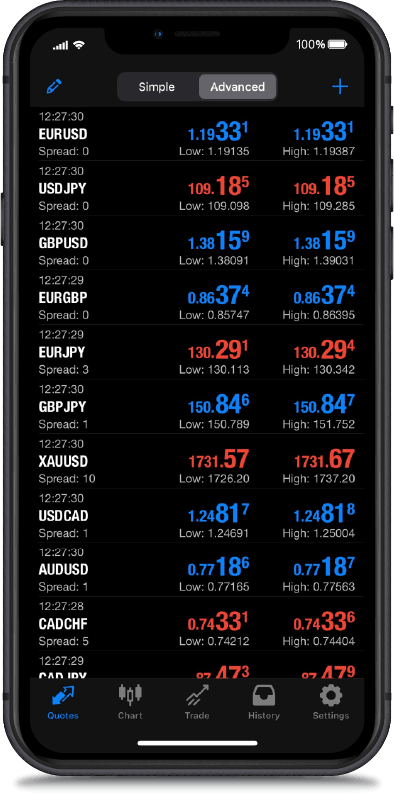

ШУУД СПРЕД

EUR / USD

SPREAD

0.00

ЗАРАХ ХАНШ

-----

АВАХ ХАНШ

-----

XAU / USD

SPREAD

0.90

ЗАРАХ ХАНШ

-----

АВАХ ХАНШ

-----

EUR / JPY

SPREAD

0.10

ЗАРАХ ХАНШ

-----

АВАХ ХАНШ

-----

USD / JPY

SPREAD

0.00

ЗАРАХ ХАНШ

-----

АВАХ ХАНШ

-----

GBP / USD

SPREAD

0.20

ЗАРАХ ХАНШ

-----

АВАХ ХАНШ

-----

Шууд үнэ нь зөвхөн үзүүлэлт юм.

СТАНДАРТ

Шимтгэлгүй

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Орлого хийх доод хэмжээ $100

- хөшүүргийн дээд хэмжээ 1 : 500

RAW

Low Commission

$2.5/side

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Орлого хийх доод хэмжээ $100

- хөшүүргийн дээд хэмжээ 1 : 500

ТАНД ХАМГИЙН ТОХИРОМЖТОЙ

ДАНСНЫ ТӨРӨЛ

ДАНСНЫ ТӨРӨЛ

RADEX MARKETS өрсөлдөхүйц арилжааны тохиргоо, гүйцэтгэлийг санал болгон ажиллаж байна.

БИДЭНТЭЙ ХАМТ АРИЛЖААНЫ АЯЛАЛАА НЭГ АЛХАМ АХИУЛААРАЙ

Бидний санал болгож буй оновчтой шинэлэг шийдлүүдийг өөрийн арилжаандаа нэвтрүүлэн урьд өмнө хэзээ ч байгаагүй арилжааг хийцгээе. Манай хэрэглэгчдэд ээлтэй платформ нь зах зээлийг хялбархан удирдах боломжийг танд олгоно.