O SEU CORRETOR DE CONFIANÇA

PARA NEGOCIAÇÃO

PARA NEGOCIAÇÃO

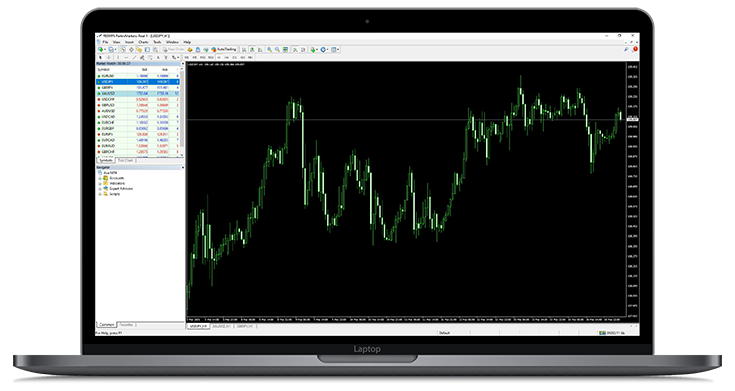

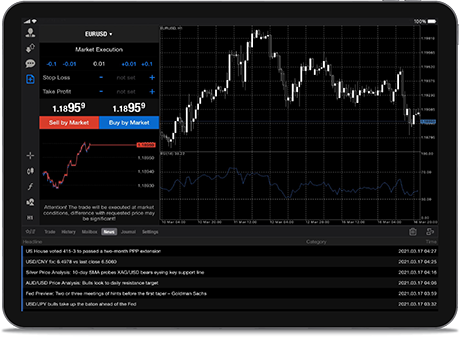

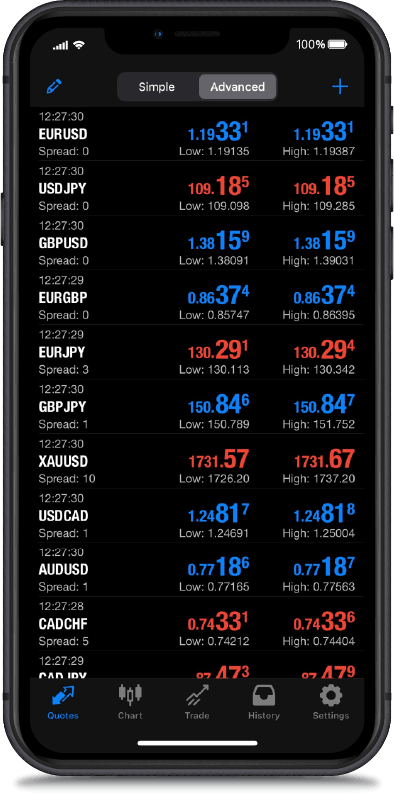

Aceda a mais de 350 produtos, incluindo forex, CFD de ações, Índices e metais com as plataformas MetaTrader 4/5

SPREADS EM TEMPO REAL

EUR / USD

SPREAD

0.00

COMPRA

-----

VENDA

-----

XAU / USD

SPREAD

0.90

COMPRA

-----

VENDA

-----

EUR / JPY

SPREAD

0.10

COMPRA

-----

VENDA

-----

USD / JPY

SPREAD

0.00

COMPRA

-----

VENDA

-----

GBP / USD

SPREAD

0.20

COMPRA

-----

VENDA

-----

Os preços em tempo real são meramente indicativos.

STANDARD

Sem comissões

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Depósito mín. $100

- Alavancagem máx. 1 : 500

RAW

Comissão baixa

2.5 USD/lado

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Depósito mín. $100

- Alavancagem máx. 1 : 500

TIPO DE CONTA

MAIS ADEQUADA A SI

MAIS ADEQUADA A SI

Na RADEX MARKETS, estamos empenhados em oferecer configurações e execuções de negociação competitivas.

MELHORE A SUA JORNADA DE NEGOCIAÇÕES CONNOSCO

Negocie como nunca antes fez, com as nossas funções excelentes.

A nossa plataforma integrada e de fácil utilização permite-lhe navegar nos mercados com facilidade.