The blockchain is the backbone of the cryptocurrency sphere. The purpose of this article is to explain what a blockchain is, and why such a design was chosen.

Bitcoin was the first cryptocurrency, the one that started it all off. The Bitcoin blockchain is therefore the first to ever be implemented, and remains the longest running chain currently in use. But what was the reason for creating Bitcoin in the first place? Why blockchain as an architecture? We can get the answer to this straight from the horse’s mouth. Satoshi Nakamoto, the mysterious creator of Bitcoin, in his first ever forum post, stated the following:

“[Bitcoin] is completely decentralized, with no central server or trusted parties, because everything is based on crypto proof instead of trust”

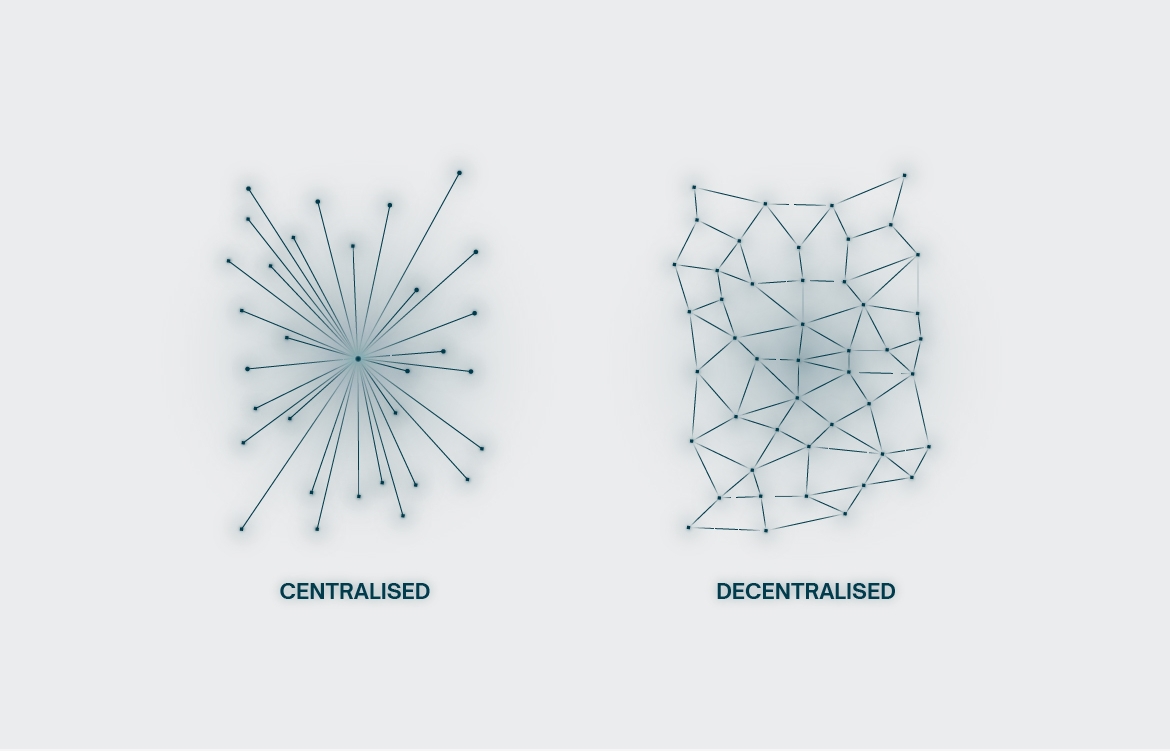

The goal here is to create a monetary system that publicly tracks transactions and balances, in a way that isn’t safeguarded by a single entity. Essentially, to create a public ledger that cannot be changed or controlled by one party. Decentralisation is the important word here, and remains the primary design aspect behind blockchain technology to this day.

The public ledger is shared among all willing participants in a decentralised network of nodes. There is no central authority, no one to dictate who owns what. Anyone willing to contribute to the blockchain can help store and secure the chain of transactions. In essence, the blockchain exists simultaneously within every node of the network. As the chain updates, so too must every node that hosts it. Like with many design aspects of blockchain technology, the degree of decentralisation falls along a scale as opposed to well-defined categories.

This digital public ledger would be conceived much like a real-life, paper ledger. Each page notes a series of transactions, leading to the next page, only making sense when reading each page in succession. The blockchain would follow a similar structure. Each page would be represented by a block. Each block would include a number of transactions, and once full would be added to the previous block, so on and so forth, forming a continuous chain of blocks, hence the term blockchain. The present state of the blockchain informs us of every transaction that has ever been made, and by extension the balance of every wallet that has ever been created.

But how does one add to the ledger? How is a block added to the chain? Who decides what gets added to it and what doesn’t? If we imagine a completely open system which allowed anyone to add whatever transactions they wanted, then people would simply give themselves a million dollars of crypto anytime they pleased. The system would be completely unreliable. There needs to be a mechanism to ensure good behaviour. This is where mining comes in.

Adding a block to the blockchain requires solving an extremely complex cryptographic problem. Solving this problem is referred to as mining and requires a vast amount of computing power. A miner expends a large amount of energy in order to mine a block and add it to the chain. The reward for doing so comes in the form of the cryptocurrency they are mining. Energy is the barrier to entry; it is what secures the network. This paradigm is known as proof of work and is the integral design choice of many of the most well-known cryptocurrencies.

Let’s look into the implications of this. If a bad actor wanted to add their own transactions and give themselves a bunch of crypto, they would need to setup their own mining operation and mine blocks until they rearrange the chain to their liking. This would cost a huge amount of energy to achieve. The financial burden of carrying out such an operation would make it unworthwhile most of the time. Moreover, we have to remember that the rest of the network has a financial incentive to stop the nefarious actor. Other miners are heavily invested into their operations and have every reason to deploy their own processing power to maintain network integrity. Even if the bad actor somehow succeeded, the particular cryptocurrency on which the operation was carried out would now be in the hands of a single party. In order to reorder a blockchain, the actor would need to possess a majority of the processing power securing it, effectively centralising it, rendering it untrustworthy and therefore worthless.

Some may raise the issue of electricity consumption as a pitfall of blockchain technology. It isn’t. The high energy expenditure is precisely what secures proof of work blockchains. The fact that someone would need an inordinate amount of energy to corrupt a blockchain is obviously in the technology’s favour.

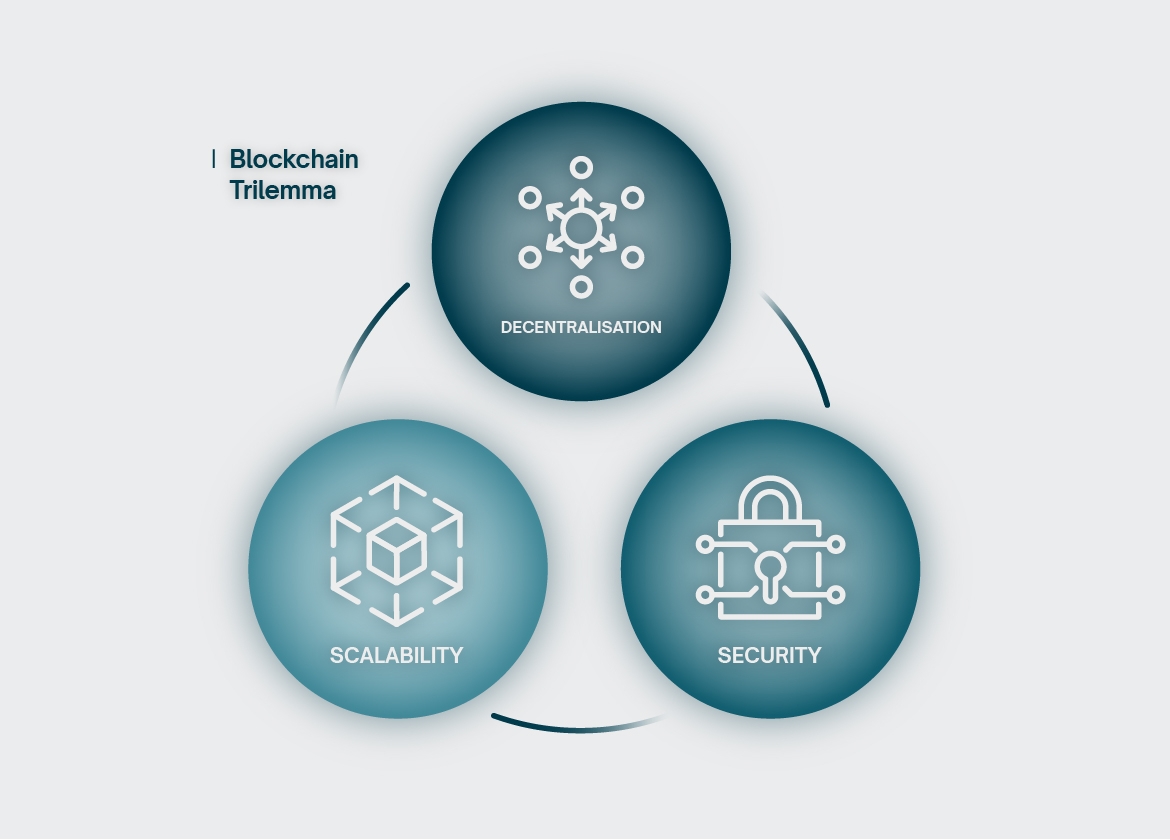

Of course, making a blockchain both extremely secure and decentralised comes at a cost. That cost is speed. A large distributed network needs time to come to any real consensus. This restricts its potential to scale, limiting its usefulness for things like commerce, for which speed is of the essence. This is the prevailing argument in the Bitcoin community. Decentralisation and security at all costs. If you want speed, use something else.

Blockchains all face the same question: what’s the most important factor? Decentralisation, security, or speed (and therefore scalability). This is known as the blockchain trilemma. Essentially, it’s impossible to have all three. One needs to be sacrificed for the other two.

We’ve covered the case in which speed is sacrificed, let’s look at the second case: security is sacrificed. You have a fast and decentralised system, but also a very fragile one. Think of a shared spreadsheet with many contributors. The barrier to entry is low and there is little incentive to behave honestly. Very useful for certain tasks but it wouldn’t take much effort for a single bad actor to ruin everything.

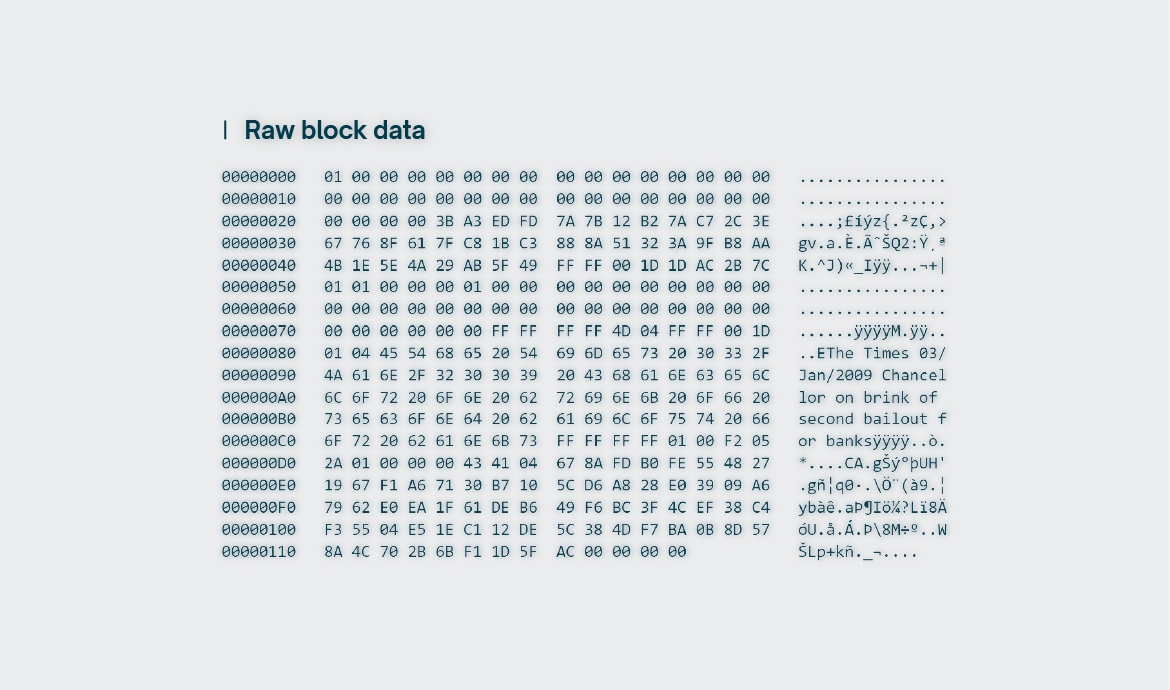

Third case: decentralisation is sacrificed. You have a fast and secure system, but at this point why bother with blockchain technology at all? May as well use a thoroughly audited banking app. To answer this, let us turn once again to the one who kicked this all off. The raw data of the bitcoin genesis block, that is to say the first block of the bitcoin blockchain, contains the following:

“Chancellor on brink of second bailout for banks”

The excerpt comes from the front page of The Times from the 3rd of January 2009, and is representative of exactly the kind of behaviour Satoshi Nakamoto was so vehemently fighting against. As he stated himself: “The root problem with conventional currency is all the trust that's required to make it work”. In an era of ever-decreasing purchasing power it’s safe to say that trust levels are now at an all-time low.

In no uncertain terms, blockchain technology was invented to wrestle control of money out of the hands of unaccountable bureaucrats and back into the hands of the common man. That’s the point of all of this. The technical arguments regarding how exactly to achieve this devolve into almost infinite complexity; the philosophical debates underpinning them are even more heated. Whether it’s Bitcoin, Ethereum, Doge or the flavour of the month venture capitalist scam coin, there is a broad scale of seriousness to contend with here. Like with any human endeavour, the wheat needs to be separated from the chaff. To those unwilling to discern, reconsider.

Advertencia de riesgos : Productos derivados del trading y productos potenciados poseen un nivel más alto de riesgo.

ABRIR CUENTA