One of the absolute key factors in the health of any given economy is its access to cheap energy. Energy is the main driver of industrial production and its availability is inarguably vital to the wellbeing of the general population. Although certain regions of the world are going to great lengths to wean themselves off it in favour of supposedly greener pastures, oil remains the backbone of power generation throughout the globe. Given its importance to every economy on Earth, it is little wonder that it receives so much attention as a financial asset. This leads us to the issue of how to attach a price to it. This is where the Brent Crude and West Texas Intermediate indices come in. The following article will provide a basic primer on what these indices are.

ORIGINS

The most prominent difference between Brent Crude and West Texas Intermediate is geographic. Brent Crude oil is extracted from under the North Sea, between the Shetland Islands and Norway; WTI on the other hand mainly comes out of the ground in Texas, Louisiana and North Dakota. Other indices also have roles to play in the international trade of oil, for example the Dubai/Oman crude and the OPEC basket, however their impact on global commodities markets is less pervasive.

The geographical, and indeed geological constraints of each type of oil, directly lead to differences in how they are delivered. WTI is very much a landlocked index. The oil is extracted out of the ground on US soil, transported across land and then processed in American refineries. The final product is made available mid-continent in the small town of Cushing, Oklahoma, and does not represent a good ready for export. The USA obviously does export oil, but the pricing of such falls slightly out of the remit of the WTI index. Brent Crude on the other hand is deliverable on sea, and as such has near instant global reach.

This is a major reason that Brent remains the global standard for the pricing of oil worldwide, despite a huge increase in American production in recent years. More than just its accessibility, Brent Crude benefits from its location, straddling several continents and connecting Eastern and Western oil markets.

The geographical distinction extends to where these benchmarks are hosted. Brent Crude currently trades on the Intercontinental Exchange (ICE) whereas West Texas Intermediate trades on the New York Mercantile Exchange (NYMEX).

SUPPLY AND DEMAND

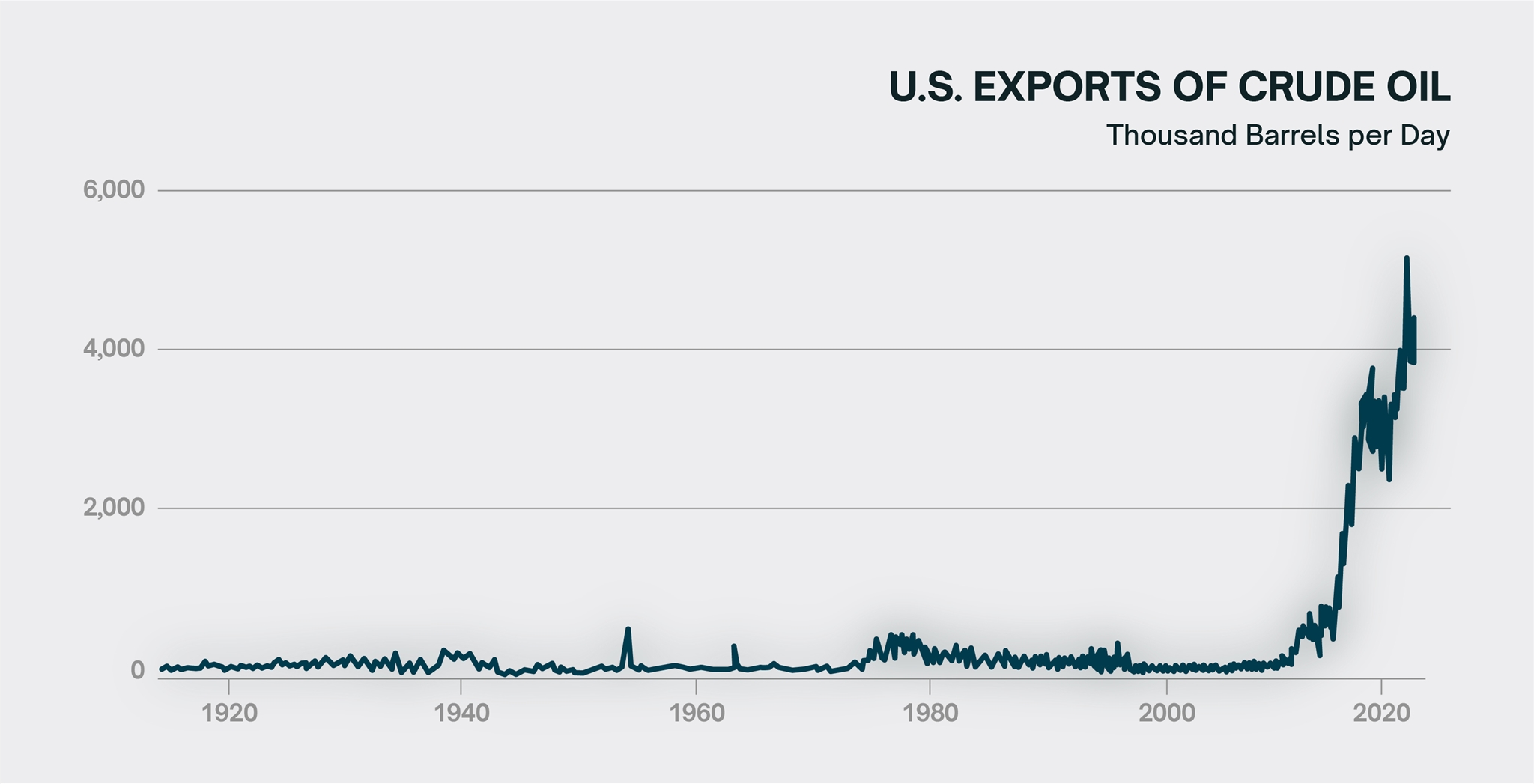

Many dynamics come into play for the pricing of each index. Historically Brent was cheaper than its US counterpart because of the ease in extracting and transporting the oil in maritime conditions. This changed around 2008 when the US experienced a huge shale oil boom, allowing it to greatly expand production. (Data source: US energy information administration )

(Data source: US energy information administration )

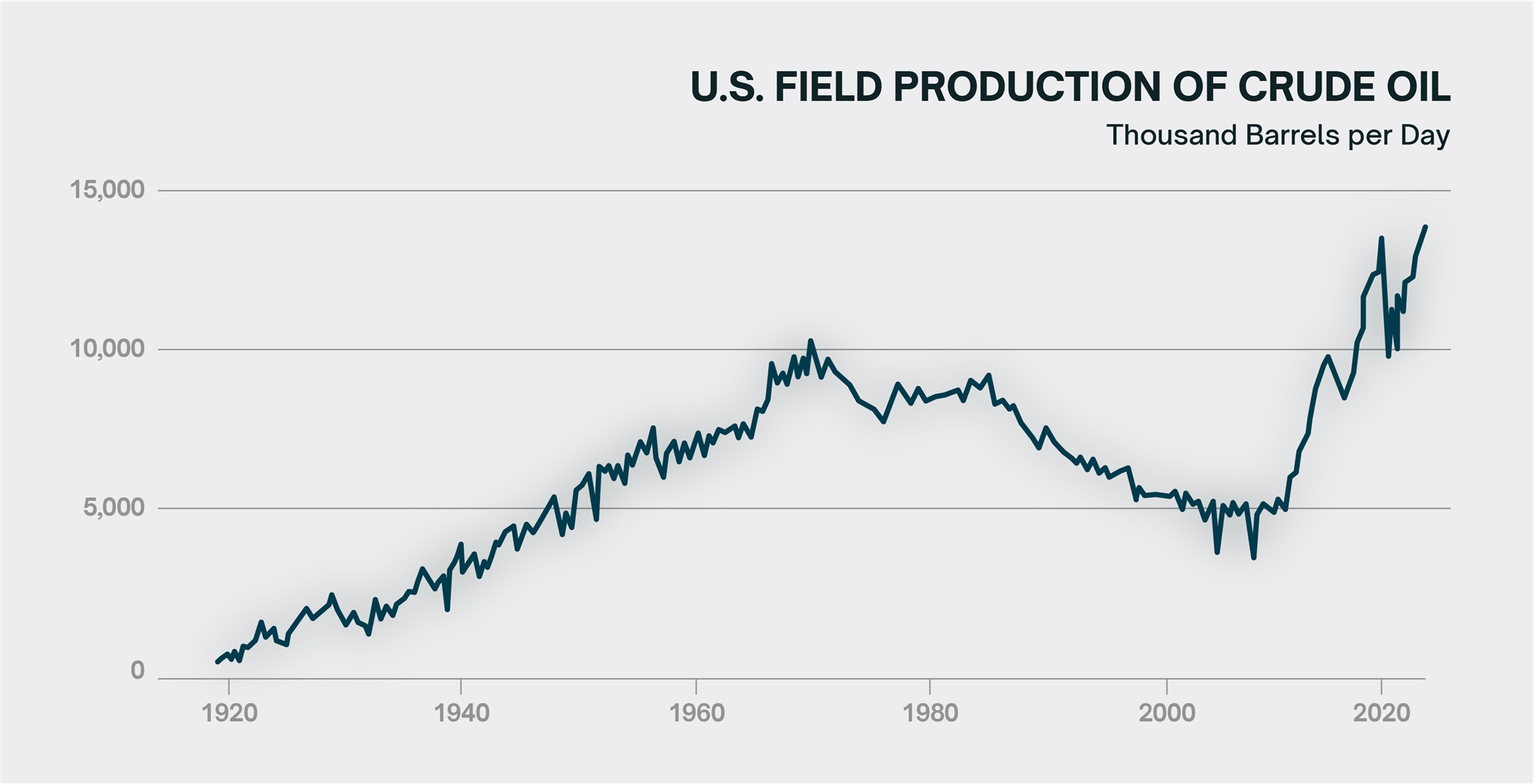

This expansion in supply, coupled with a decrease in North Sea outputs, would close the gap between the price of Brent and WTI, before eventually leading the former to become the more expensive. The increase in production would also allow the US to massively ramp up its crude oil exports, indirectly increasing the relevance of the WTI index on the world stage.

(Data source: US energy information administration )

(Data source: US energy information administration )

As stated previously, the WTI index indicates the price of oil as deliverable in a small town in the middle of the US. By the time it reaches a port in the Gulf of Mexico, this price becomes somewhat irrelevant. This is where various secondary indices come into play, such as WTI Houston, which represents the far more relevant price of oil as available at the point of delivery onto a ship. Needless to say, due to market forces, this latter price is much more intimately tied to the Brent Crude price.

This presents an interesting paradox: the importance of the WTI index increases in tandem with growing US oil exports, which is somewhat awkward because the WTI was never intended to price an export commodity. The inward-facing nature of the WTI has another consequence, intentional or not: it is much more isolated from international events. Because Brent Crude pricing is tied not just to European markets but also to those further afield, such as those in the Middle East, it is far more sensitive to geopolitical concerns. During periods of strife, such as those witnessed during the Arab Spring, or more recently in Gaza and the Red Sea, the Brent Crude/WTI spread tends to increase as the former is more affected than the latter.

FUTURE OUTLOOK

As of today, the Brent Crude index serves as the pricing benchmark for about three quarters of all crude oil exports, due to its more global and mercantile nature. Given the shifting geopolitical landscape, one has to wonder how long the current paradigm will continue to prevail however. Although such a question would have been unthinkable just a few decades ago, the fact remains that US production is increasing year after year, whereas the output of its traditional competitors is not. North Sea oil production has more than halved since its peak in the late 1990s, to the point where countries like the UK are now net importers of crude. Traditionally, the Gulf countries have benefited tremendously from their vast crude reserves, as have the members of the wider OPEC cartel, allowing them a large degree of influence over international oil markets. This influence has waned somewhat in recent years however, pressured by the huge increases in production in the United States and the Americas as a whole. The oil market is no stranger to bouts of economic warfare between its largest contributors, but the events observed in recent years suggest a more permanent paradigm shift. Whether this leads to changes in nomenclature or not remains to be seen, but for now Brent Crude and West Texas intermediate will remain at the forefront of any discussion pertaining to oil markets.

Amaran Risiko : Perdagangan derivatif dan produk berleveraj mempunyai tahap risiko yang tinggi.

BUKA AKAUN