On Monday the 19th of October 1987, the Dow Jones Industrial Average fell 508 points. Wiping almost 23% off its market cap, it was the largest daily loss in relative terms in the index’s history and would send ripples around the globe.

BACKGROUND AND CAUSES

The economic context of the 1980s is an important factor in the crash, even though it was by no means the actual trigger of the event. The mid-eighties saw strong and consistent growth throughout the globe and this was reflected in asset prices and stock markets worldwide. Japan in particular was in the grips of an economic miracle thanks to a strong export economy, largely facilitated by an artificially weak Yen. Unfortunately, this led to a trade imbalance with the United States, which sought to remedy the issue by implementing the Plaza Accord, one of the main purposes of which was to depreciate the Dollar in order to re-establish some semblance of equilibrium with the rest of the world. The agreement worked very well, resulting in the Dollar losing value against other major currencies. Perhaps even a little too well in fact, the Dollar lost so much value that policy makers had to step in once again to reverse course. The agreement responsible for setting things straight the second time was to be the Louvre Accord, which sought to halt the continued decline of the Dollar. Unfortunately, the latter agreement would not be anywhere near as effective. The dwindling Dollar could not be halted and would become a significant factor in the subsequent stock market crash.

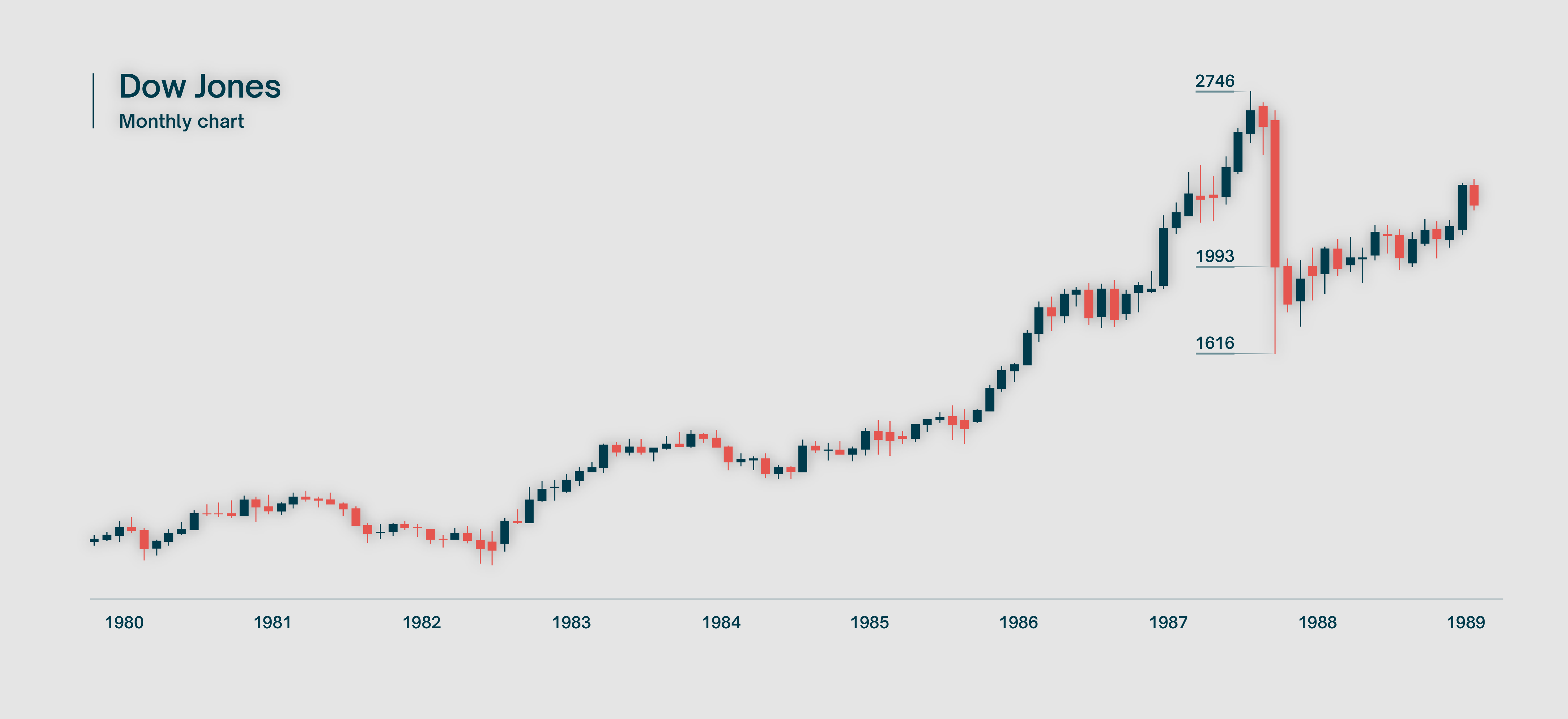

The second part of the answer is perhaps the simplest. After the better part of a decade of solid growth, asset prices in general were somewhat inflated. The Dow Jones had almost tripled in the last five years alone, a performance by no means uncharacteristic of the times.

The above sets the stage, and can perhaps explain the early selling, but the rapid collapse that ensued had another driver. By 1987, programmatic stock trading, that is to say the buying and selling of stocks based solely on market movements, had become a common tool for traders. Portfolio insurance hedging is one such instance, the purpose of which is to limit losses during major declines in price, decreasing exposure to the market in times of strife. The problem with such tools is that they aren’t based on any fundamental knowledge of the market, they simply execute when a certain condition is met, in the same way that Expert Advisors work today. Early selling pressure may have triggered further automated sells, further suppressing prices, triggering further selling action, and so on and so forth in an unstoppable feedback loop.

The last point to be made lies simply in market psychology. Much like their computer-generated counterpoints, traders were not driven by fundamental knowledge either, but by price action alone. Fear is a powerful emotion and trading floors worldwide were firmly in its grip, their only escape the riddance of their holdings.

THE CRASH

Although Black Monday is commonly associated with the Dow and other US indices, the event was very much a worldwide event, erasing roughly $1.7 trillion in asset valuations across the globe. Selling pressure had already stepped in the previous week, but Monday the 19th bore the brunt of the crash. As Asian markets opened, it would be the Hong Kong Stock Exchange that would set the stage for what was to come. The Hang Seng Index would lose 10% that day, and after seeing the subsequent chaos in Europe, then in the US, the HKSE committee elected to close markets for the rest of the week.

As the European markets opened, the London FTSE 100 plummeted almost 300 points, a loss of 14 percent. This would grow to 23% by the end of the following day. The German DAX would lose 9.4%.

By the time the US markets were ready to open, everyone had their fingers firmly on the sell button. When markets finally did open on Monday morning, the selling pressure was immediate and sustained. Trading volumes were high enough to overwhelm computers and force trading halts and delays throughout the day. By the time the dust had settled, the DJI had lost 22.6% of its market cap, the biggest loss since 1929.

Japan had escaped the crash so far but would not remain unscathed for long. The crash of 1987 is actually known as “Blue Tuesday” in Japan due its timing. The colour descriptive also offers a clue as to its severity: the Nikkei 225 fell 14.9% on the day but would fully recover in a matter of months. Although it would suffer its own collapse a few years later, for the time being the Japanese stock market would largely shrug off the events of Black Monday.

AFTER EFFECTS

The same cannot be said for other parts of the world. In New Zealand, the stock market would go on to lose 60% of its value, eventually triggering a recession that would last until 1993. The collapse in Australian asset values would also have more permanent consequences to the landscape of its economy. Without being flippant about it, the 1987 crash “popped the bubble” in many markets, some of which were understood to be overvalued even at the time.

Economic effects aside, the biggest long-term changes were technological. The stock market crash of 1987 directly led to the implementation of circuit breakers that are ubiquitous in stock markets around the world today. Different markets operate their circuit breakers differently, some triggering more easily than others, but their purpose is the same: to stop runaway price action and stabilise markets. The first threshold halts trading for a short period of time, typically around 15 minutes. Subsequent circuit breakers may halt trading for the rest of the day depending on the severity of the price moves. Although such measures are not infallible, as demonstrated with the flash crash of 2010 for example, they certainly could have gone some way to mitigating the crash of 1987.

As for US markets, and in particular the Dow Jones Industrial Average, the impact of Black Monday would be short lived. It would take less than two years to recapture pre-crash valuations. Three decades after that, those valuations would be surpassed tenfold.

Amaran Risiko : Perdagangan derivatif dan produk berleveraj mempunyai tahap risiko yang tinggi.

BUKA AKAUN