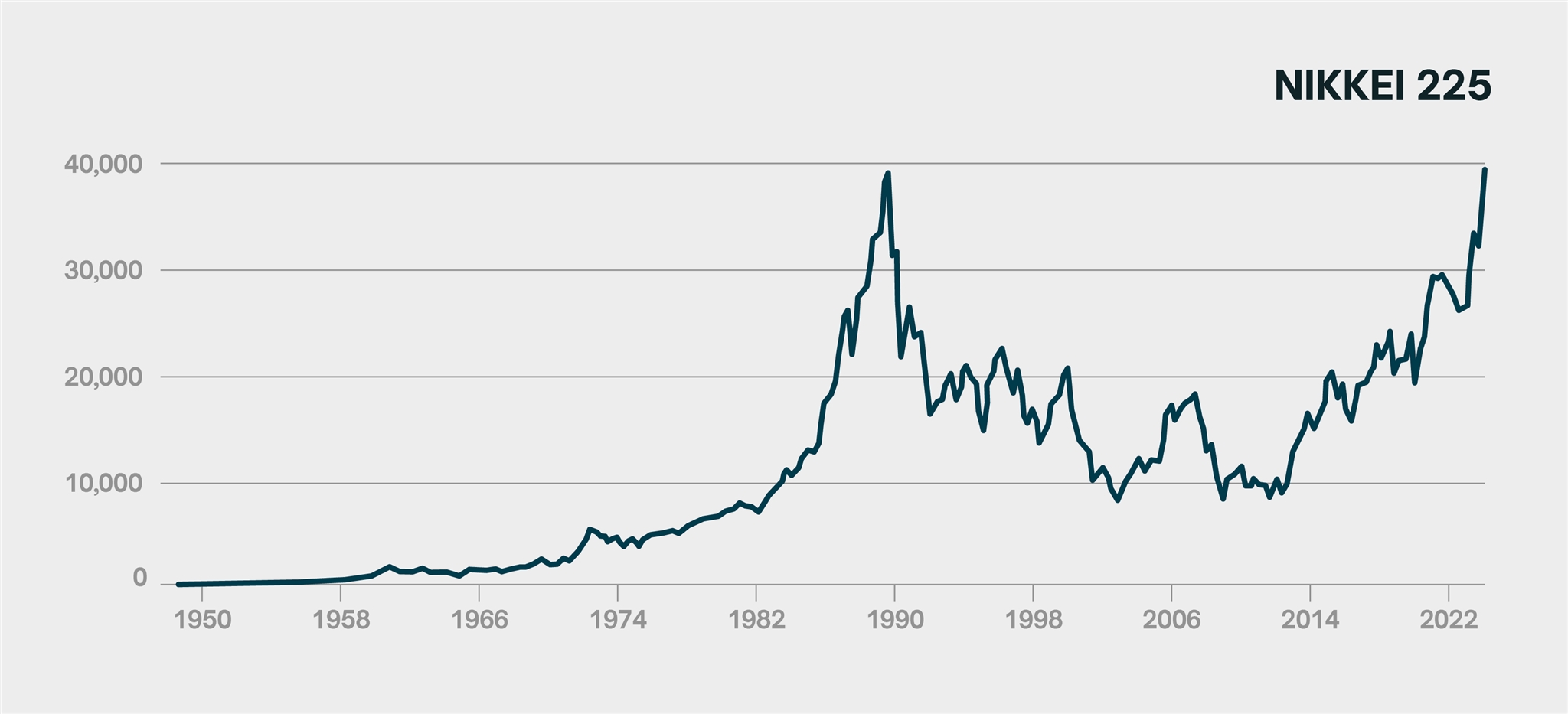

On the 29th of December 1989, the Nikkei 225 index hit an all-time high of 38,957 Yen.

It would take 34 years for such a valuation to be surpassed.

The Nikkei 225 derives its name from the Nihon Keizai Shimbun, a Tokyo-based financial newspaper that calculates the index, and the 225 publicly traded Japanese companies that comprise it. The purpose of the index, much like any other stock index, was to act as a barometer for the general health and strength of Japanese markets. Stock trading in Japan was not permitted for several years following the end of the Second World War so when the ban expired there was a renewed appetite surrounding financial markets. Calculation of the Nikkei 225 index started on the 7th of September 1950 and the financial newspaper published the results daily. 70 years later, the index is somewhat more expedient, updating every 5 seconds.

First issue of the newspaper, published in 1876

Although the index went live 1950, it was retroactively calculated to the 16th of May 1949, at a price of 176.21 Yen. The following year would actually see a bear trend culminating in lows of 85.25 in July 1950. This would be the biggest drawdown in relative terms for the next 40 years.

It is impossible to talk about the Nikkei 225 without also talking about the Japanese economy in general. The index fulfilled its purpose well, serving as a reflection of the greater economic performance of the nation. The post-war reconstruction period saw extraordinary growth that would continue unabated for roughly four decades and the Nikkei 225 would mirror this perfectly. True to its purpose, the index would then go on to illustrate the brutal decline the Japanese economy subsequently underwent.

THE RISE

Following its inception, the Nikkei 225 would undergo strong and consistent gains for the remainder of the 1950s, closing at 874 points on the 28th of December 1959. The foundations for rebuilding the Japanese economy were in place, even during this early stage the rocket was primed for take-off. The following decade would continue where the previous left off, almost tripling the valuation of the index all the way up to 2348 Yen by the end of the 1960s. The 70s would see a similar return, tripling the price of the index again to 6569 points. A mere taste of what was to come.

By the 1980s, the main driver of the Japanese economy was its massive export surplus. Japanese products were all the rage and due to a very weak Yen they were very competitively priced, resulting in huge capital flows into Japanese companies. Unfortunately, this created a large trade imbalance between Japan and the Western hemisphere, so much so that worlds leaders met to address and resolve the issue. The ensuing negotiations resulted in the 1985 Plaza accord, the purpose of which was to devalue the USD and restore some semblance of balance to the international trade of goods. The agreement resulted in a rapid appreciation of the Yen, which destroyed the competitive edge of Japanese products, dramatically reducing exports, concluding in a very short-lived recession, known as the Endaka recession.

To counter the recession, the Bank of Japan switched to a policy of monetary easing, which increased access to credit and reduced funding costs. The official discount rate was brought from 5% at the start of 1986 all the way down to 2.5% a year later. The readily available capital allowed companies to expand rapidly, increasing their balance sheets and collateral, which further increased their access to funding, creating a vicious cycle which would massively inflate asset prices. The intricacies of Japanese land tax further exacerbated the problem by creating an extremely illiquid real estate market. This is the time during which fortunes were made, people from all walks of life benefitting from the tremendous wealth that flooded into the Japanese economy. It was the period that Japan became famous for, heavily influencing the culture at the time and serving as the backdrop for a huge quantity of media that continues to be produced to this day.

The above conditions created the perfect breeding grounds for meteoric rises in stock valuations, leading to a parabolic trend in the Nikkei 225. Surely this was too good to be true – a fledgling sentiment of caution began to emerge. The Bank of Japan began to realise something was amiss as early as summer 1988 but their voice was drowned out by the mania of the times. Another year would go by before the BoJ would actively start tightening the money supply by bringing the discount rate back up from 2.5% all the way up to 6%. Unfortunately, this would have no impact on the money supply until the early 90s. Too little, too late. In the meanwhile, the Nikkei 225 continued on its seemingly unstoppable run.

THE FALL

On the final trading day of the decade, the bubble popped. On the 29th of December 1989, the index hit an intra-day high of 38,957.44 before closing the day at 38,915.87 Yen; it had gone up 500% in the last ten years.

The easy money had dried up and there was nothing to prop up valuations any longer. Decades of depreciation would follow. Nine months later the Nikkei 225 had halved, dragging many aspects of the Japanese economy with it. Incredibly, this was just the beginning. It would take another 19 years for it to find a bottom. This came on the 28th of October 2008 with an intra-day low of 6,994.90 Yen, down 82% from its all-time high. Four years of sideways price action would follow before any sense of bullish momentum would return to the index.

The fall in the Nikkei 225 illustrates the collapse of the Japanese economy in general. The following years saw asset prices, company valuations, land prices, GDP and real wages all plummet. Japan’s economic miracle had ended and the Lost Decade swiftly took its place. The Lost Decade eventually became the Lost 20 Years, which in turn became the Lost 30 Years. The Japanese economy would experience anaemic growth during this time, leaving nothing for the subsequent generations entering the workforce. In the same way that the euphoria of the 80s heavily influenced the culture of the nation, so too would the desolation of the 90s. The collapse had a profound impact on Japan, its media, culture, and people.

The performance of the Nikkei is an oddity as far as stock indices are concerned. No other index has followed a path even remotely similar. A 19-year bear market is incredible in itself, but no other stock index in the world can boast all-time highs that persisted for over three decades.

RISE AGAIN

Thirty –four years is a long time, particularly in a nation as historically resilient as Japan. Following the crash, monetary policy makers tried the usual path of low interest rates in order to stimulate borrowing and spending but the confidence in the economy simply was not there. Japanese markets would finally make some headway and in the early 2000s, the Nikkei 225 finally experienced some form of rebound. Unfortunately, the recovery would be short-lived as the global financial crisis of 2008 was just around the corner, undoing much of the fragile growth achieved since the turn of the century.

The economic recovery had experienced a significant setback but was not defeated just yet. The stagnation endured until the Bank of Japan started down the more aggressive route of purchasing government bonds and exchange traded funds in 2013. The policy fell in line with the more encompassing “Abenomics”, named after Prime Minister Shinzo Abe, who sought to address the problems that had beleaguered the Japanese economy for over twenty years at that point. Such measures would finally give Japanese markets the confidence they needed to emerge out of their decades-long slump, this time for good. The BoJ’s aggressive stock buying programme continued and such measures are arguably responsible for a significant portion of the subsequent growth in the Nikkei 225 index. The central bank is in fact now the largest owner of Japanese stocks, with valuations in the ballpark of half a trillion USD.

In 2013 alone, the Nikkei 225 would increase in value by over 50%. Over the next ten years, it would continue to climb with only minor setbacks along the way. In 2023, the index would close out the year 28% higher and put it within striking distance of its former all-time high. Less than two months into 2024, on the 22nd of February, it achieved exactly that.

The Nikkei 225, emblematic of the fall from the dizzying heights of the roaring 80s, has clawed its way back to the top after 34 long years. The achievement needs no embellishment.

Amaran Risiko : Perdagangan derivatif dan produk berleveraj mempunyai tahap risiko yang tinggi.

BUKA AKAUN