IL PROPRIO BROKER DI RIFERIMENTO

PER IL TRADING

PER IL TRADING

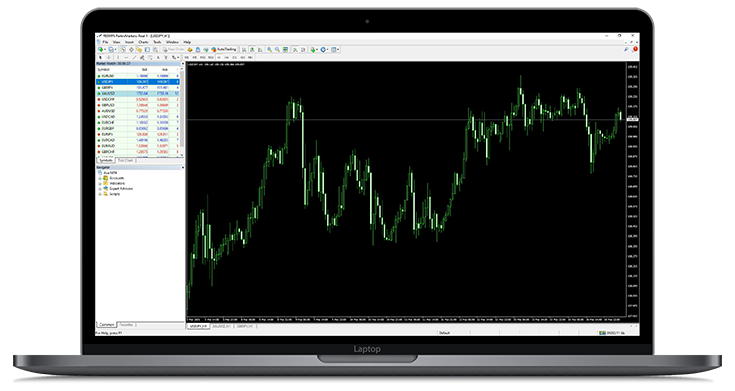

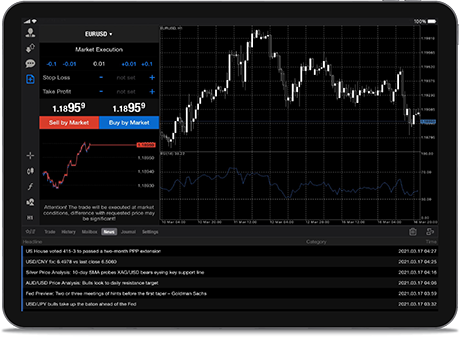

Accedi a oltre 350 prodotti inclusi i CFD su forex,

su azioni, su indici e su metalli con le piattaforme MT4 e MT5

su azioni, su indici e su metalli con le piattaforme MT4 e MT5

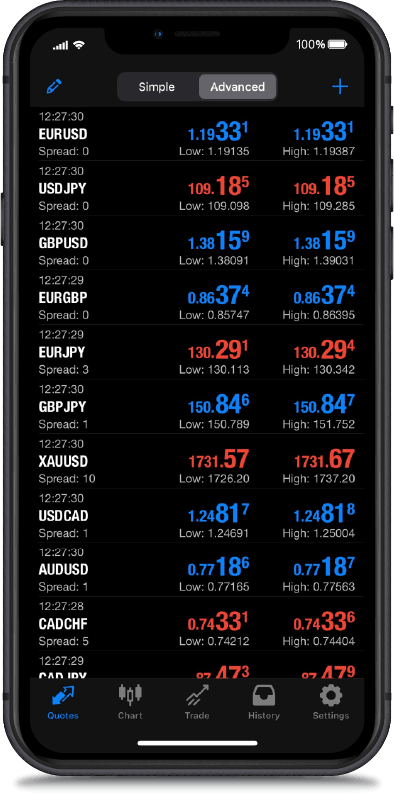

SPREAD IN TEMPO REALE

EUR / USD

SPREAD

0.00

OFFERTA

-----

CHIEDI

-----

XAU / USD

SPREAD

0.90

OFFERTA

-----

CHIEDI

-----

EUR / JPY

SPREAD

0.10

OFFERTA

-----

CHIEDI

-----

USD / JPY

SPREAD

0.00

OFFERTA

-----

CHIEDI

-----

GBP / USD

SPREAD

0.20

OFFERTA

-----

CHIEDI

-----

I prezzi in tempo reale sono solo indicativi.

STANDARD

Nessuna commissione

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Deposito minimo $100

- Leva massima 1 : 500

RAW

Commissione bassa

$2.5/lato

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Deposito minimo $100

- Leva massima 1 : 500

TIPO DI CONTO

CHE MEGLIO SI ADATTA

CHE MEGLIO SI ADATTA

A RADEX MARKETS, ci impegniamo ad offrire configurazioni ed esecuzioni di trading competitive.

MIGLIORARE IL PROPRIO TRADING VIAGGIARE CON NOI

Fare trading come mai prima d'ora con le nostre funzionalità ottimali. La nostra piattaforma semplice e intuitiva consente di navigare nei mercati con facilità.