นายหน้าซื้อขายหลักทรัพย์ของคุณ

สำหรับการซื้อขาย

สำหรับการซื้อขาย

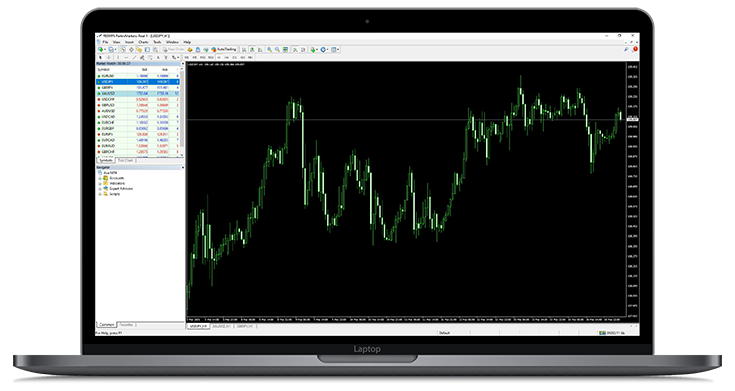

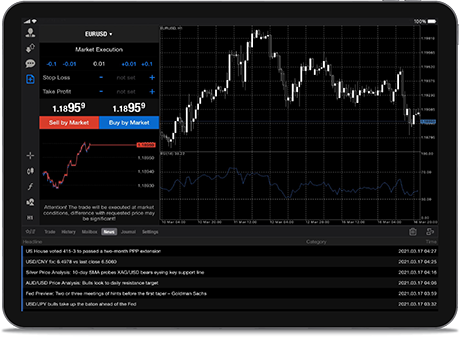

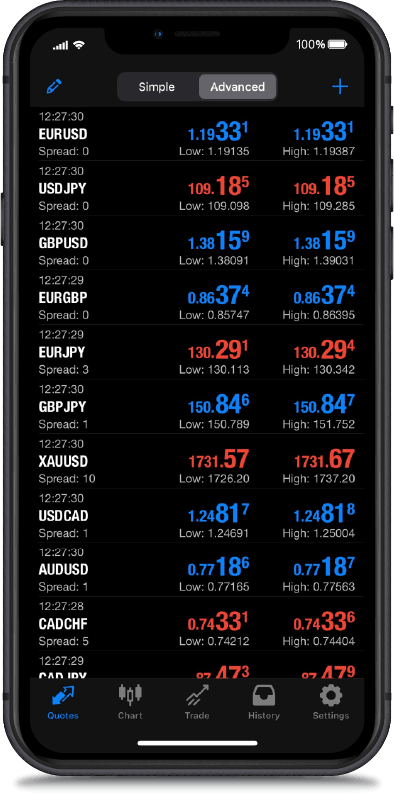

เข้าถึงผลิตภัณฑ์กว่า 1000 รายการรวมถึง Forex, หุ้น, CFDs, สินค้าโภคภัณฑ์, ดัชนี และโลหะด้วยแพลตฟอร์ม MetaTrader 4.

สเปรดสด

EUR / USD

สเปร

0.00

BID

-----

ASK

-----

XAU / USD

สเปร

0.90

BID

-----

ASK

-----

EUR / JPY

สเปร

0.10

BID

-----

ASK

-----

USD / JPY

สเปร

0.00

BID

-----

ASK

-----

GBP / USD

สเปร

0.20

BID

-----

ASK

-----

ราคาสดเป็นตัวบ่งชี้เท่านั้น

มาตรฐาน

No Commission

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Min. Deposit $100

- Max. Leverage 1 : 500

RAW

Low Commission

$2.5/side

PIPS

XAU/USD

PIPS

EUR/USD

PIPS

USD/JPY

PIPS

EUR/JPY

PIPS

GBP/USD

PIPS

EUR/GBP

- Min. Deposit $100

- Max. Leverage 1 : 500

ประเภทบัญชี

ที่เหมาะกับคุณที่สุด

ที่เหมาะกับคุณที่สุด

ที่ RADEX MARKETS เราให้คำมั่นสัญญาในการนำเสนอการตั้งค่าการซื้อขายและการดำเนินการที่แข่งขันได้

พิ่มประสิทธิภาพการซื้อขายของคุณร่วมเดินทางไปกับเรา

ซื้อขายอย่างที่ไม่เคยมีมาก่อนด้วยคุณสมบัติที่ดีที่สุดของเรา แพลตฟอร์มที่ราบรื่นและใช้งานง่ายของเราช่วยให้คุณนำทางตลาดได้อย่างง่ายดาย